Having a robust pricing strategy is crucial for achieving lasting success. Pricing isn’t just a number; it’s a strategic lever that can significantly affect your profitability, market positioning, and ability to retain customers. For B2B companies, crafting a pricing strategy involves navigating a complex environment where multiple stakeholders are involved, sales cycles can stretch for months, and contracts often reach substantial values.

With 63% of B2B purchasing decisions influenced by teams of at least three decision-makers, understanding how to effectively price your offerings becomes paramount. An optimised pricing model enables businesses to balance cost recovery with attractive pricing, ensuring profitability while meeting customer needs.

So, how can you build a pricing strategy that works for your specific context? What elements should you consider? In this guide, we’ll explore the various pricing models available to B2B companies and how flexible pricing and quoting capabilities can transform your approach.

The significance of flexible pricing & quoting in B2B retail

1. Customisation & competitive advantage

B2B customers increasingly demand personalised pricing solutions that reflect their unique buying behaviours, contract agreements, and historical relationships. Implementing flexible pricing strategies allows businesses to cater to diverse customer segments with tailored offers. This is particularly important in the B2B space, where volume discounts, loyalty programs, and special pricing arrangements can significantly influence purchasing decisions.

Using custom catalogues that display tailored pricing structures based on a customer’s negotiation history fosters a sense of partnership and trust. According to industry standards, organisations that leverage advanced pricing models experience a marked increase in customer retention and overall satisfaction.

2. Streamlined quoting processes with CPQ solutions

Configure, Price, Quote (CPQ) software is a game changer for B2B retail organisations. By automating the quoting process, CPQ solutions enable sales teams to generate accurate, timely, and personalised quotes in response to customer inquiries. This not only accelerates the sales cycle but also ensures that pricing reflects the most current market conditions and customer agreements.

Integrating CPQ solutions within the B2B trade portal allows for real-time access to customer data and pricing rules. As a result, sales representatives can provide clients with quick, accurate quotes that account for discounts, promotions, and credit terms, ultimately leading to faster deal closures.

3. Dynamic pricing models

Dynamic pricing strategies that adjust based on real-time market conditions empower B2B retailers to optimise profit margins and enhance competitiveness. This approach allows businesses to respond to fluctuations in demand, inventory levels, and competitor pricing without requiring manual intervention.

By utilising data analytics and machine learning algorithms, organisations can forecast demand and adjust prices accordingly. These models help maintain a balance between profitability and customer satisfaction, ensuring that businesses remain agile in the ever-changing B2B landscape.

4. Integration with RFQ processes

Request for Quotation (RFQ) processes are integral to B2B commerce, particularly in sectors requiring tailored solutions and complex pricing structures. By integrating flexible pricing capabilities with RFQ workflows, businesses can streamline the collection of quotes from multiple suppliers and provide comprehensive responses to their clients.

Automated RFQ management systems enable organisations to manage requests efficiently, ensuring that pricing is consistent, transparent, and reflective of current market conditions. This capability fosters better supplier relationships and enhances the procurement process, making it easier for buyers to make informed decisions.

5. Enhanced cash flow and payment flexibility

Flexible pricing models can significantly enhance cash flow management. By offering varied payment terms and online payment gateways, B2B retailers can cater to the financial needs of their clients while optimising their own cash flow. For instance, instalment payments or deferred payment plans can help secure larger orders, as clients feel less financial pressure.

Incorporating these payment options within the digital service layer ensures seamless transactions, providing customers with multiple avenues to complete purchases, thereby enhancing their overall experience.

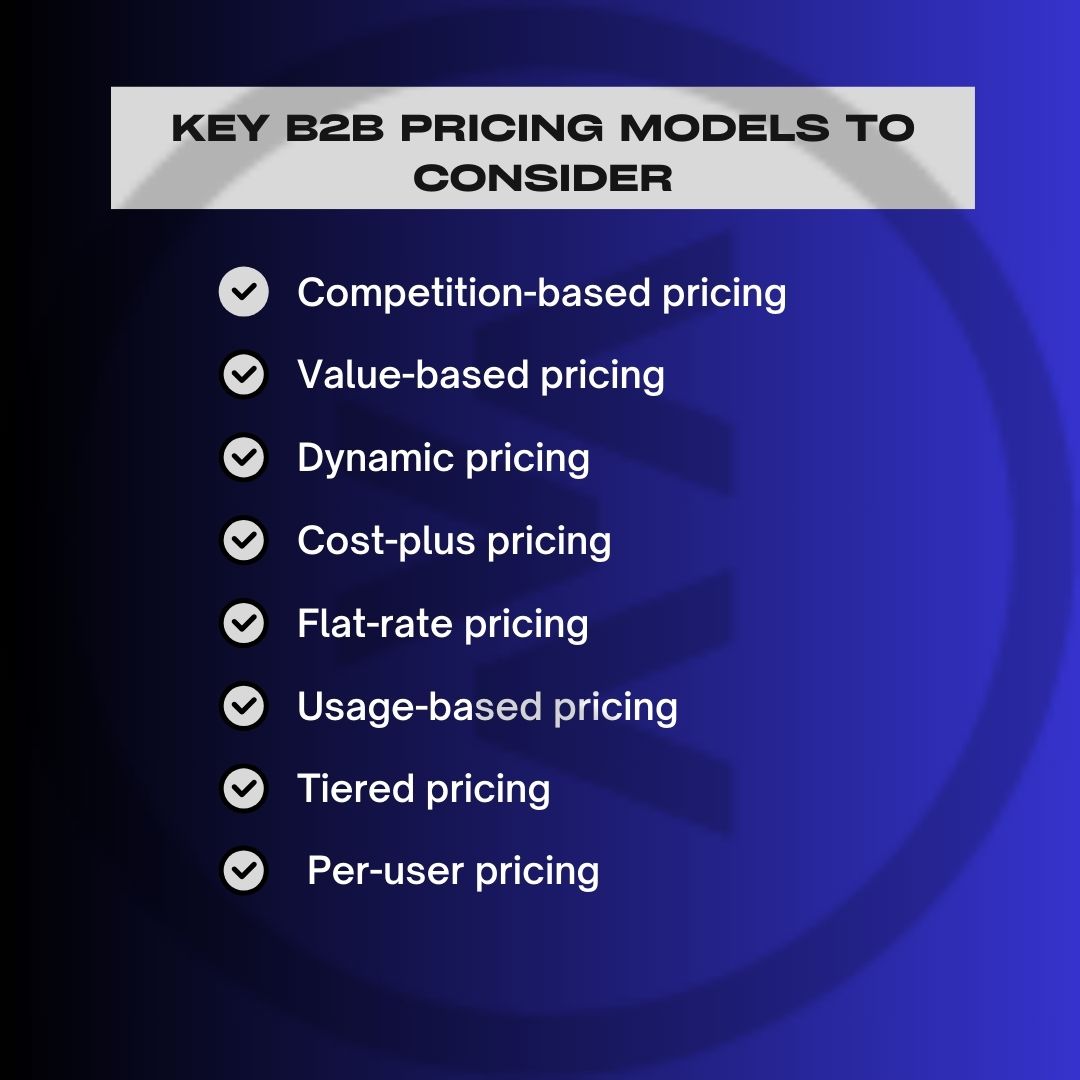

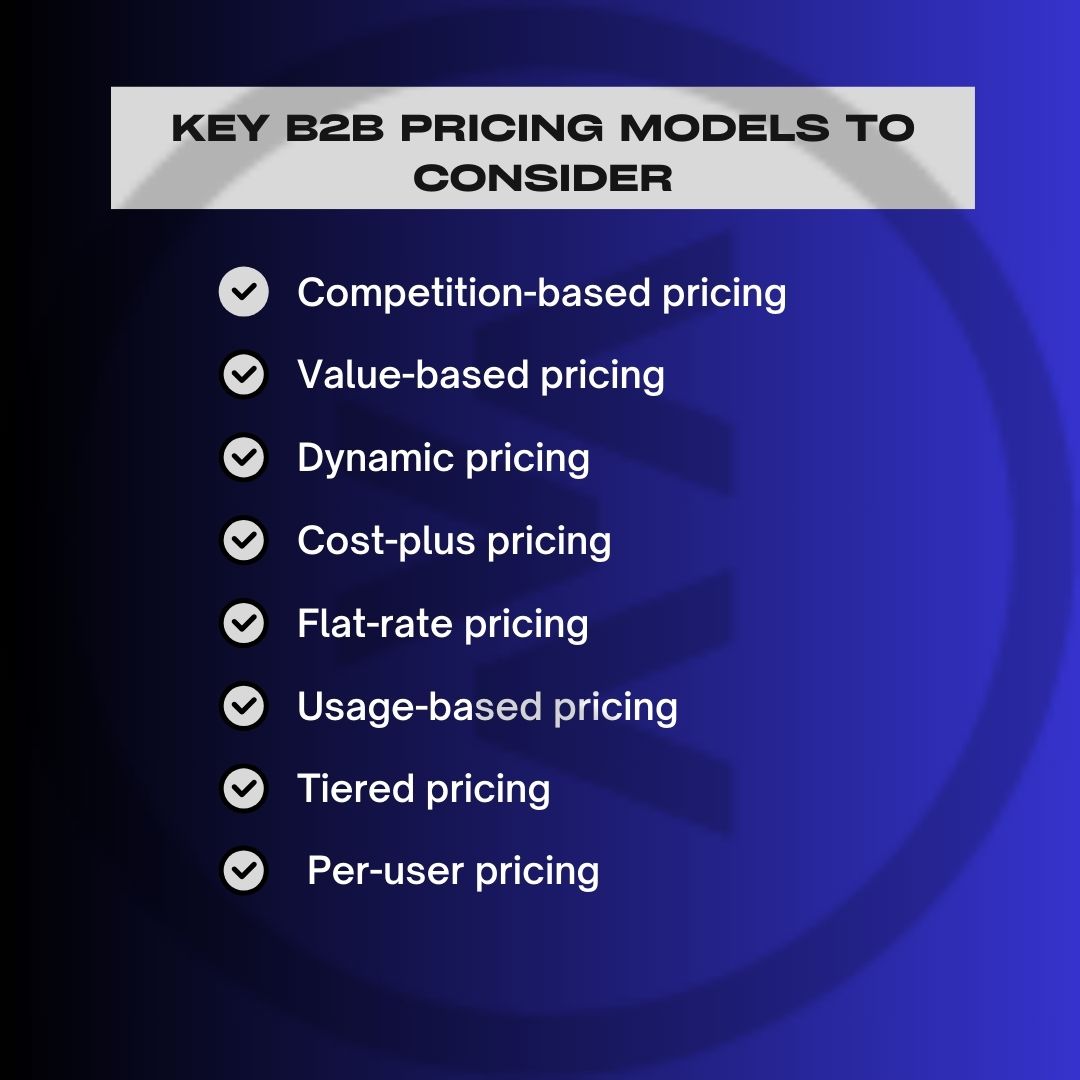

Key B2B pricing models to consider

Selecting the right pricing model for your business hinges on several factors, including industry, cost structure, and customer preferences. Here are some prominent B2B pricing strategies that can enhance your approach:

#1 Competition-based pricing

This common strategy involves analysing competitor pricing to establish a baseline. By adjusting prices slightly above or below competitors, businesses can position themselves effectively within the market. This model is particularly useful in saturated markets where products are similar.

#2 Value-based pricing

In industries where differentiation is significant, such as luxury goods or software, businesses can benefit from a value-based pricing strategy. This approach focuses on setting prices based on the perceived value of the product rather than production costs or competitor pricing. By capturing what customers are willing to pay, businesses can maximise revenue from premium offerings.

#3 Dynamic pricing

Dynamic pricing allows prices to fluctuate in real time based on market demand, competitor pricing, and other factors. This strategy enables businesses to adapt quickly to changes in the market, optimising profit margins. For example, prices may rise during peak demand periods and decrease during slower times.

#4 Cost-plus pricing

This straightforward model involves calculating the total production costs and adding a markup percentage to achieve a desired profit margin. Cost-plus pricing is particularly effective in industries with standardised products and can help ensure consistent profitability.

#5 Flat-rate pricing

In flat-rate pricing, businesses charge a fixed price regardless of usage or purchase volume. This model simplifies transactions and is often used in industries like SaaS, where a monthly fee is charged for access to software, regardless of usage levels.

#6 Usage-based pricing

Also known as pay-as-you-go pricing, this model charges customers based on their actual consumption. This is ideal for services requiring ongoing support, allowing businesses to align costs with customer usage and ensuring fairness in pricing.

#7 Tiered pricing

Tiered pricing offers multiple price points based on features and functionality. This model allows businesses to cater to various customer segments and encourages upselling opportunities, enhancing overall customer satisfaction.

#8 Per-user pricing

Commonly used in SaaS, per-user pricing charges fees based on the number of licenses purchased. This strategy captures more value from larger organisations while offering affordable options for smaller customers.

Implementing flexible pricing and quoting capabilities

- Invest in robust technology solutions

To achieve effective pricing and quoting flexibility, B2B retailers must invest in technology that supports these capabilities. A comprehensive commerce platform integrated with CPQ tools and pricing management features is essential. Solutions like Salesforce's B2B Commerce platform provide the necessary tools to automate and streamline pricing strategies, enhancing the overall customer experience.

- Leverage data analytics for decision-making

Harnessing the power of data analytics enables businesses to understand customer behaviour, preferences, and pricing sensitivities. By analysing this data, organisations can refine their pricing strategies, ensuring they are not only competitive but also aligned with customer expectations.

- Training and development for sales teams

Equipping sales teams with the necessary skills and knowledge to utilise flexible pricing and quoting tools is critical. Regular training sessions should focus on leveraging CPQ solutions, understanding pricing structures, and utilising data to make informed pricing decisions.

- Establish clear pricing guidelines

Developing transparent pricing guidelines that outline how flexible pricing works within the organisation helps maintain consistency and builds trust with customers. Clear documentation of discount tiers, volume pricing, and promotional offers ensures that sales representatives can effectively communicate pricing structures to clients.

Conclusion

In the dynamic realm of B2B retail commerce, the integration of flexible pricing and quoting capabilities is no longer an option but a critical imperative. By harnessing advanced technology, data analytics, and streamlined processes, organisations can enhance their pricing strategies to meet the evolving demands of their clients.

For c-suite executives and decision-makers, prioritising flexible pricing and quoting will not only drive revenue growth but also foster stronger customer relationships and enhance competitive advantage. As the B2B landscape continues to evolve, those who adapt swiftly and intelligently will position themselves for sustained success in the marketplace.

.jpg?w=3840&q=75)

.png?w=3840&q=75)

.jpg?w=3840&q=75)